Big Change in 2013 LCD TV Panel Supply

By David Hsieh

Since Q2’12, the LCD TV panel market has witnessed a shift in screen sizes, with new models focused on 28”, 29”, 39”, 43”, 48”, 50”, 58” and 60” displays. The rise of the new sizes has become the hottest topic in the LCD TV market. According to the Quarterly Large-Area TFT Panel Shipment Report, these new LCD TV panel sizes accounted for 12 percent of total LCD TV panels shipped in Q3’12, up from 5 percent in Q1’12 and 8 percent in Q2’12. We forecast that the share of these new sizes will stabilize in Q4’12 before passing 15 percent in 1H’13, based on panel makers’ shipment plans. We expect the new sizes to change the LCD TV panel supply in 2013.

Changes in the product mix of the LCD TV panel makers will be driven by some of the panel makers are moving to produce the most efficient sizes, regardless of the market demand. After a period of losses, panel makers will prioritize profit margins to survive. So, while the end market might prefer 32” which is comparatively cheaper, panel makers may have to cut 32” panel allocation in order to produce 39”, which has a higher panel price and in better production efficiency.

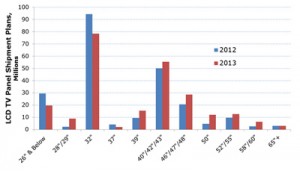

2012-2013 LCD TV Panel Shipment Plans

Source: Quarterly Large-Area TFT Panel Shipment Report

The largest change will be in 32”, the supply of which will fall from 94 million in 2012 to 79 million in 2013. The decrease is due to a product mix shift in Gen 6 and 8 fabs, with panel makers planning to produce more 39” on Gen 6 and 46” or 55” on Gen 8. Meanwhile, 26” will be replaced by 28/29”, which will be increased by 7 million. Both 39” and 50” sizes are quite popular in many regions, and panel makers plan to ship 15 million 39” panels and 12 million 50” panels in 2013, substantial growth from 2012. Capacity on Gen 6 and 7 lines will be allocated to produce the 39” and 50”, respectively. Finally, panel makers are determined to expand the larger size LCD TV market, with 50” and larger panel shipments expected to increase from 20 million in 2012, to 34 million in 2013. Such growth would also be critical to consuming a large amount of LCD capacity in area terms.

For LCD TV panel buyers, it will be very challenging in 2013 to secure panel supply in certain sizes, while preventing inventory to accumulate in other sizes, as the end market demand might be quite different. Allocation as well as inventory control will be higher priority than panel pricing, while availability of some sizes will be more important than panel technology or quality. The value chain relationships between panel makers and TV brands might be more complicated in 2013, as TV brands might have to qualify new panel suppliers quickly and adjust allocation of the existing suppliers in order to secure supply of certain sizes.