Weak Income Growth Will Compel Retailers to Invest in Omni-Channel Marketing Technology

Digital technologies are disrupting traditional shopping channels and are changing the relationship between retailers and consumers. This will accelerate retail technology investments, as the move to implement omni-channel marketing solutions advances.1 Another important trend that retailers should be watching is moderate growth in consumer income. Weakness in consumer disposable income, and thus the ability to spend, will force retailers to compete harder for the same consumer dollar. Top-line growth will be much harder to realize, and the opportunities offered by various technologies will provide a major impetus to achieve competitive advantage.

Trends in Consumer Income and Spending

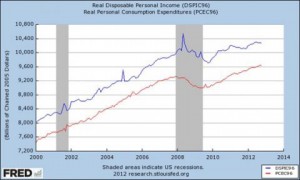

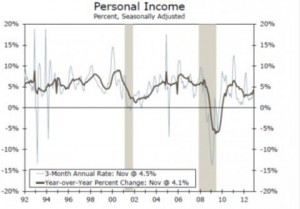

Income, borrowing and savings are major influences on consumer spending (as is net worth, which is not addressed here). Of these, income has the most sway over spending (see Chart 1, illustrating the correlation between income and spending). For most of 2012, income growth has been weak (November was the exception to this, with personal income up 0.6 percent, the strongest since February). Year-on-year, personal income rose just 4.1 percent (see Chart 2). Compare this to 5.1 percent in 2011 and 3.8 percent in 2010, and the trend is not encouraging.

Chart 1

Source: Wells Fargo Economics Group

Chart 2

The trend in wages, the major contributor to income, is cause for concern. As Chart 3 illustrates, real average hourly earnings were flat in November 2012 versus November 2011. Weekly earnings were down slightly in November 2012 versus November 2011. Wage and salary growth is running 3.7 percent this year versus 4.0 percent in 2011.

Chart 3

Current and real (constant 1982 to 1984) earnings for all employees on private nonfarm payrolls, seasonally adjusted

Nov. 2011 Sept. 2012 Oct. 2012 Nov. 2012

Real average hourly earnings $10.23 $10.20 $10.18 $10.23

Real average weekly earnings $352.01 $351.84 $350.16 $351.85

Source: Bureau of Labor Statistics, Department of Labo

Improvements in income in November led to an increase in consumer spending (up 0.4 percent). But for the year, consumer spending is up 3.5 percent, trailing 2011’s 5.0 percent increase and 2010’s 3.8 percent gain. As Chart 4 illustrates, the long-term change in spending growth is also weak.

Chart 4

Source: Federal Reserve Bank of St. Louis

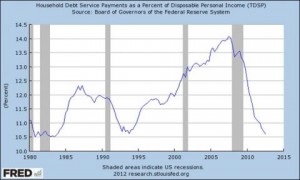

During the boom years leading up to the Great Recession, consumers were borrowing heavily to fuel spending. But today, consumers are managing their debt levels to better reflect their ability to support it. As the following Charts 5 and 6 illustrate, consumer debt payments and debt levels are being reduced.

Chart 5

Source: Federal Reserve Bank of St. Louis

Chart 6.

Source: Federal Reserve Bank of St. Louis

It is our view that increases in retail sales have tended to come from savings, rather than increases in income, and this is not sustainable. As Chart 7 illustrates, the saving rate has been decreasing since 2011 (November, again, was the exception to the overall trend), when retail sales grew by 8.0 percent (see Chart 8).

Chart 7

Source: Federal Reserve Bank of St. Louis

Chart 8

Source: Haver Analytics

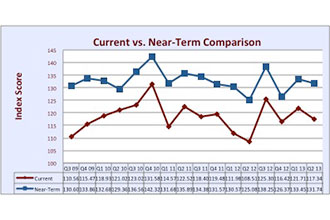

This inverse relationship between savings and retail sales is illustrated in Chart 9. What this demonstrates is that as savings go up (the red line); retail sales go down (the blue line). Likewise, when savings go down, retail sales have tended to increase.

Chart 9

Source: Federal Reserve Bank of St. Louis

Recognizing that for the next 12 to 24 months, consumer income and spending will likely continue to be subdued, we advance that to maintain and grow market share, retailers should be aggressively investing in technology.

Consumer Income and Spending Trends Will Fuel Technology Investments

It has long been recognized that investments in IT can secure competitive advantage.2 On the other hand, such advantage can be short-lived, as competitors adopt and implement the same technologies. Over time, such investments become necessities rather than a means of achieving competitive advantage. This raises the question of whether investments in omni-channel marketing technologies, with the objective of achieving a unified customer experience and view, will lead to a sustainable business advantage.

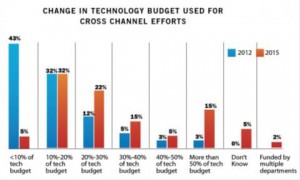

It is clear that omni-channel is the technology du jour, being implemented and closely watched by many retailers. As the following Chart 10 illustrates, for example, 15 percent of retailers surveyed expect to spend more than 50 percent of their entire tech budget on omni-channel initiatives by 2015, up from 3 percent in 2012.

Chart 10

Source: RIS News’ Sixth Annual Cross-Channel Tech Trends Study

Omni-channel technology investments will create sustainable retail business advantage. This is not because adoption will be limited to the few. In fact, as Chart 10 above illustrates, many retailers will be investing. But unlike many other technologies, successful omni-channel execution requires significant marketing analysis and execution. Thus, ingenuity and creativity will separate the good from the not so good. For example, two retailers may aggregate data from various channels to achieve a singular customer view, but how each then responds is what will create differentiation and advantage. Will a personalized offer be generated? Will this information be incorporated into mobile POS devices so that a sales associate can optimize services offered to customers in the store? Will predictive analytics lead to timely offers being communicated simultaneously to a specific customer segment via mobile, online and in-store channels? What becomes clear is that as these technologies enable marketers to have direct, real-time contact with customers, it is the nature of that dialogue, not the technology, which will create competitive advantage.

A weak outlook for growth in consumer income will constrain consumer spending. This will make the battle for the shopper’s dollar harder than ever. This, in addition to changing consumer purchase patterns, should lead retailers to implement omni-channel marketing technologies. Unlike many other technologies, omni-channel investments can lead to long-term competitive advantage, as a retailer’s marketing skills will drive a customer-centric solution that achieves the desired response from customers.

1See, for example, the “2012 Cross-Channel Tech Trends Study,” which advanced that “retailers will step up their cross-channel initiatives significantly over the next few years.” RIS, October 2012, p. 3.

2 See, i.e., “IS Redraws Competitive Boundaries,” Harvard Business Review, March-April 1985.

Copyright © Platt Retail Institute 2013 and reprinted with permission. All rights reserved. See the entire PRI Resource Library at www.plattretailinstitute.org/library.