HDTV Sales Decline

In 2011, worldwide TV shipments fell for the first time since NPD DisplaySearch began tracking global TV shipments in 2004, slipping 0.3 percent to 247.7M units. As reported in the latest NPD DisplaySearch Quarterly Global TV Shipment and Forecast Report, LCD TV shipments increased by 7 percent to just over 205M units in 2011 — a substantial slowdown from the double digit growth in previous years. With plasma TV shipments declining almost 7 percent in 2011 to 17.2M units, the largest decline yet, and CRT shipments falling 34 percent, LCD growth was not enough to offset these declines.

In 2011, worldwide TV shipments fell for the first time since NPD DisplaySearch began tracking global TV shipments in 2004, slipping 0.3 percent to 247.7M units. As reported in the latest NPD DisplaySearch Quarterly Global TV Shipment and Forecast Report, LCD TV shipments increased by 7 percent to just over 205M units in 2011 — a substantial slowdown from the double digit growth in previous years. With plasma TV shipments declining almost 7 percent in 2011 to 17.2M units, the largest decline yet, and CRT shipments falling 34 percent, LCD growth was not enough to offset these declines.

“The causes of slow demand in 2011 were complex, and although LCD TV showed growth, results were well below industry expectations,” noted Paul Gagnon, NPD DisplaySearch director of North America TV research. Gagnon added, “The low level of shipments were partially caused by excessive inventory levels early in 2011 for the US and European markets, as well as a sharp drop in demand in Japan following the end of the government sponsored Eco-Points program that caused a surge in replacement activity during 2009-2010.”

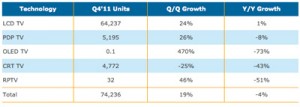

Q4’11 shipments were down 4 percent Y/Y globally to 74.2M units, with LCD TV shipments rising just 1 percent (also the lowest growth rate since NPD DisplaySearch began tracking shipments). Plasma TV units were down 8 percent and CRTs were down 43 percent. The decline in units was most pronounced in Japan and Western Europe with only mild growth in North America. Collectively, TV shipments in the developed regions (North America, Japan and Western Europe) declined 21 percent Y/Y in Q4’11. TV shipment growth in emerging regions continues to be strong though, increasing 12 percent Y/Y in Q4’11 with LCD TV unit shipments rising 20 percent.

The LCD TV shipment share increased to a record 86.5 percent of global TV shipments in Q4’11, up from 83 percent in Q3’11 and 82 percent one year ago. LCD TV shipment growth is strongest in larger screen sizes with very aggressively priced models shipping for the holiday season. Shipments of 40″ and larger LCD TVs rose 20 percent Y/Y while sub-40″ fell 7 percent. Average prices for 40/42″ LCD TVs were down 11 percent Y/Y, and 60″+ average LCD TV prices were down more than 16 percent Y/Y. LED backlight penetration continues to grow slowly, rising above 50 percent of LCD units for the first time in Q4’11, although only about three percentage points higher than in Q3’11. The high premium for edge-lit LED LCD TVs is still an inhibitor to adoption, but new low-cost direct-lit LED models arriving in 2012 will help speed adoption.

Plasma TV unit shipments continued to decline, falling 8 percent Y/Y in Q4’11 after a 14 percent decline in Q3’11 and 6 percent decline in Q2’11. This decline demand coincides with a shift to larger screen sizes and focus on greater profitability, with the 50″+ share of plasma TV shipments increasing more than 50 percent for the first time in Q4’11.