Canalys Study Shows Investment in Cybersecurity Is on the Rise

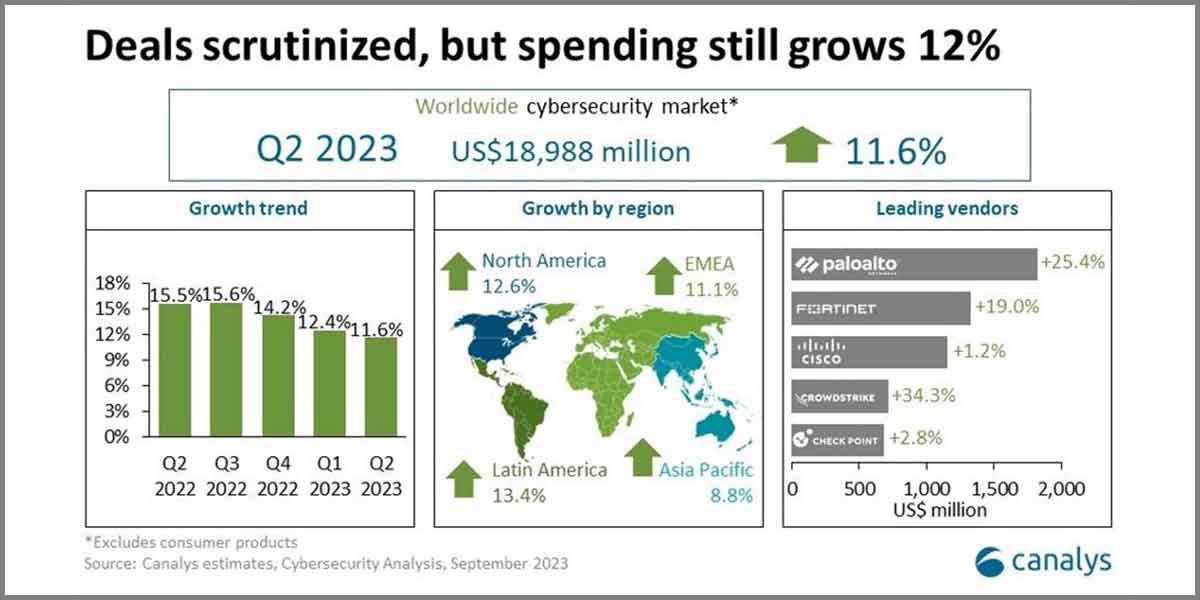

Investment in cyber-resilience remained a top priority for organizations in Q2 2023 as threat levels continued to rise. Overall, the worldwide cybersecurity technology market grew 11.6% year on year to US$19.0 billion, despite ongoing macroeconomic uncertainty and constrained IT budgets.

The top 12 vendors accounted for nearly half of this spending. Leading the market in Q2, Palo Alto Networks grew 25.4%, fueled by demand for SASE, SecOps and cloud security. Fortinet ranked second, having capitalized on further gains in network security. But its growth of 19.0% in Q2 represented a slowdown from 26.2% in Q1. Cisco accounted for 6.1% of total spending, down from 6.7% last year. Its business is transforming under new leadership, with new platform launches and more acquisitions, including its intent to purchase Splunk for US$28 billion. CrowdStrike, Check Point, Okta and Microsoft rounded out the top seven.

In Q2 2023, total cybersecurity technology spending through the channel accounted for 91.5%, up from 90.5% in the same quarter a year ago.

Customers need channel partners with cybersecurity expertise more than ever to help build cyber-resilience. Canalys says this is a key theme at the 2023 Canalys Forums. At the EMEA event in Barcelona, sessions discussing the threat landscape and neutralizing attack surfaces, as well as a panel of CEOs from Proofpoint, SonicWall and Trend Micro, emphasized the need for partners to build more service-led engagements with customers and collaborate more with specialists to expand capabilities in areas such as red teaming and MDR. It was also highlighted that vendors needed to improve collaboration with each other, especially around integration and sharing data. More partner and vendor sessions will be held at the Canalys Forum North America in Palm Springs next month and at the Canalys Forum APAC in Bangkok in December.

On a regional basis, spending remained resilient in North America (+12.6%), which is the next destination of the Canalys Channel Forums (13 to 15 November), EMEA (+11.1%) and Latin America (+13.4%). But growth rates slowed in Asia Pacific (+8.8%), as organizations scaled back their spending.