Antifragility And Systemic Risk in the Custom Install Market

I get ribbed a lot over what one of my friends calls my “hate-crush” on Nassim Nicholas Taleb, who, if you don’t know is the author of Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets, The Black Swan: The Impact of the Highly Improbable and Antifragile: Things That Gain from Disorder.

I get ribbed a lot over what one of my friends calls my “hate-crush” on Nassim Nicholas Taleb, who, if you don’t know is the author of Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets, The Black Swan: The Impact of the Highly Improbable and Antifragile: Things That Gain from Disorder.

I’m accused of having a hate-crush because his writing in turn delights yet vexes me. His work is thought provoking, as it ought to be, but sometimes it also gets on my nerves.

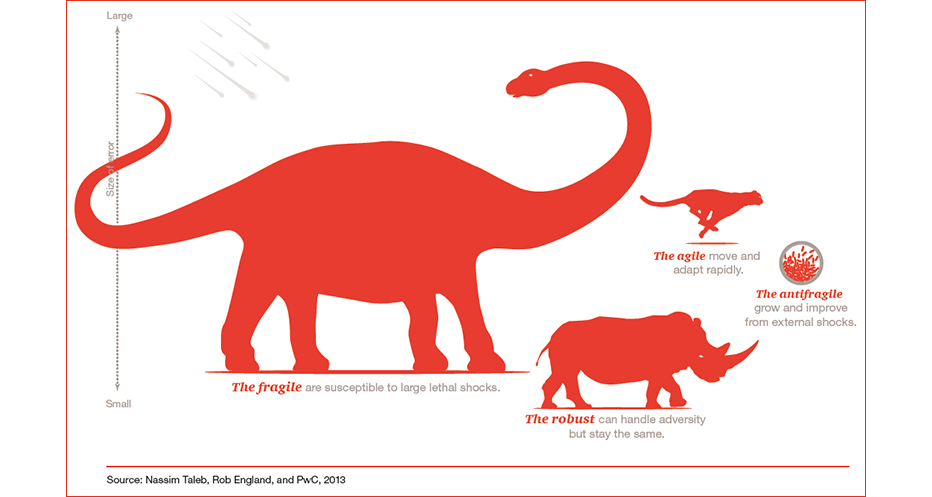

All of this is entirely beside the point — I’m not here to dissect his work, a task for which I’m admittedly poorly equipped. Rather, what I’m here to do is crib one of his concepts, systemic risk, for my own purposes, and bash it into a shape that will fit the argument I’m framing in this editorial.

A lot of business articles focus on growing your business, of which I’m all in favor. However, far fewer articles focus on keeping your business from declining, which is related but not limited to growth.

My point today is simple: The bigger your customers are, the greater the risk that your company will feel acute pain when you lose one of them, for whatever reason.

Let’s use some very simple math to illustrate my point.

Scenario A:

Let’s say your company has a million dollars in annual revenue (I told you I’d use simple math). Your revenue comes from ten customers, each doing $100,000 a year with you. Lose one, and you’re facing a decrease of 10 percent next year.

The obvious solutions are to a) grow the business of your other nine customers, which they may or may not do and b) go out and find new customers to add to your roster.

Losing 10 percent of your revenue sucks, but unless you run on razor-thin margins, or unless your cashflow and expenses are a trainwreck, it’s not typically perilous.

Now, let’s review another possiblity.

Scenario B:

Again, your company has a million dollars in annual revenue. This time you have six customers. One does $500,000 a year with you and the other five do $100,000 each. If you lose one of the $100,000 customers, your situation is much like it was in the first Scenario A. However, this time, if your #1 customer goes *poof* your situation is much more dire.

Losing 50 percent of your business hurts. A lot.

There are endless permutations of this, but whether you’re a manufacturer/distributor vending products(as I am), or an AV pro creating installations think about how your customer base is structured. It’s not always a case where the risk comes from putting all your eggs in one basket. The biggest risk can come from counting on Really Big Eggs.

As a distributor rep, I lose a few customers every year to market forces and attrition. Sometimes they go out of business (which is bad) or they get acquired by their competitors, who are often also my customer (which is good).

When a customer is a small account, I’m sorry to see them go, but I can usually expect their competitors to pick up the slack for me.

When a customer is a big account, I’m more concerned, and I have some work to do to go find more business.

On the AV pro side, install companies live and die by their deal funnel: the projects they’re working on now, the projects they have queued up to work on next, and the projects they’re bidding on and trying to secure for the future.

In my time on the install side, I was fortunate to never feel the pain of having nothing upstream in our funnel, but that was because our boss was adamant that we focus on not only massive prestige jobs with big price tags, but small and medium jobs to fill in the gaps between those six-figure progress payment checks.

We all love our biggest customers. We take pride in them, do our best to service them, and brag about them to our peers.

My solution to minimizing the systemic risk in my customer accounts is to have many smaller accounts in addition to my big marquee top accounts. And I do my best to make my smaller accounts feel special and looked-after. I never neglect a dealer or don’t take his calls just because he’s 5 percent of my total annual revenue.

Spreading out my revenue helps to insulate my business as best I can from the shocks of losing some.

Image via Nassim Nicholas Taleb and PwC