My First Thoughts on the Samsung/Harman Deal

First off, for the sake of the 8,000 or so employees of Harman, I HOPE this is a good deal. The history of mergers and buyouts in AV isn’t good. Sure, there have been some that have done well (aka Milestone), but most big one’s have failed miserably (aka: InFocus buying Proxima and the first time AMX was sold).

First off, for the sake of the 8,000 or so employees of Harman, I HOPE this is a good deal. The history of mergers and buyouts in AV isn’t good. Sure, there have been some that have done well (aka Milestone), but most big one’s have failed miserably (aka: InFocus buying Proxima and the first time AMX was sold).

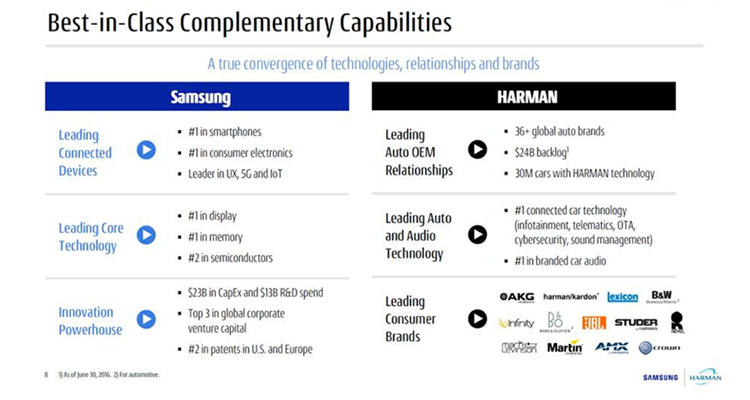

I’ve spent the better part of the morning reading and re-reading the press release issued by Samsung about their $112 per share (cash deal) to buy Harman — an $8 Billion deal. And, maybe I am being picky, but one of the only companies NOT mentioned in the release was AMX. They mentioned nearly every other Harman entity individually but they left AMX out. (However, they did mention AMX in their webinar this morning — not by name, but in an image, here, in the PowerPoint slides.)

Was this intentional or was it an accident of the likely consumer-driven PR announcement?

Well, one other thing that’s telling to me — in the press release where they talk about who is going to run the company, it says, “Upon closing, HARMAN will operate as a standalone Samsung subsidiary, and continue to be led by Dinesh Paliwal and HARMAN’s current management team. Samsung is pursuing a long-term growth strategy in automotive electronics, and plans to retain HARMAN’s work force, headquarters and facilities, as well as all of its consumer and professional audio brands.”

Note the last three words: “and professional audio brands.”

Did they write this intentionally? Did they intentionally not but “and control” or “and video,” or did the consumer-facing PR team not know that AMX is NOT an audio company? Or, was this intentional? Are they planning to spin-off AMX as a separate company or even sell it?

The part of the press release that talks about connectivity, and the buzzword of the day IoT (Internet of Things), specifically talks about the connected “automotive market.” Nothing about AMX or its control platform.

I am not saying I am right or wrong, but it’s interesting and worth considering.

As I said at the beginning of this, for the sake of the 8,000 or so employees of Harman, I HOPE this is a good deal.

Here’s a PDF sent out by Samsung on the announcement.