What If an Integrated Service Provider Offers Free LCD TVs?

By David Hsieh

DisplaySearch

Recently, there has been discussion in the Chinese LCD TV supply chain about offering free LCD TVs as a promotional tool. The conversations are a result of Alibaba, the big e-commerce provider in China, possibly planning to introduce a TV, the Ali-TV, as a shopping platform for its users. The biggest attraction is that the TV might be offered for free.

We have seen cases of telecom subsidies offering free smartphones, so why not free TVs too? In fact, a smartphone and LCD TV are actually priced similarly these days. In China, the rise of e-commence has altered the value chain structure, placing heavy pressure on TV brands. Many smart TVs are sold via e-channels at a 25 percent discount or lower. Already in China, more than 10 percent of the TV purchases are made online.

The TV business has attracted new players from internet service providers, internet content providers, and even telecom operators who are eyeing new opportunities outside of just the TV hardware itself. These emerging TV players are joining the platform, content, terminal, advertising, apps, and broadband service markets, which has created tough competition for traditional TV brands that have focused mainly on enhancing the display performance to add value.

The Alibaba Group is running a global e-commerce business that involves many business fields such as shopping, search engines, electronic payment, financing, cloud computing, and more. If Alibaba decides to offer the Ali-TV at low price points or even free of charge as an incentive to grow other promising business lines, it may face complications from a TV supply chain perspective:

- LCD TV panel supply sufficiency is improving in China. Note the recent announcement that BOE will build another two new fabs in China, one Gen 10.5 and one Gen 8.

- There are many TV OEMs/ODMs in Taiwan and China competing with each other to streamline the supply chain and costs of TV manufacturing.

- Display and TV set integration are progressing rapidly, such as the LCD TV open cell + BMS (Backlight/Module/System) model as described in the Quarterly LCD TV Value Chain & Insight Report and Quarterly LED Backlight Report.

- Many LCD fabs are going into depreciation termination. With depreciation cost around 15-20% of the LCD TV panel cost, and the LCD TV panel accounting for 70 percent of the LCD TV system cost, this will help TV makers to reduce costs (see Quarterly Worldwide FPD Shipment and Forecast Report).

- LCD TV panel makers have been working hard to increase added-value with new features such as 4K, curved, wide color gamut, and 3D. However, there is still a segment of consumers who treat TV as a pure media monitor or display. They would rather passively watch the device rather than have a smart interaction.

- Soaring panel prices have been eroding TV brand profitability (see “TV Maker Profit Margins vs. LCD

- Module Profit Margins”). So it is possible that a new business model launched by a non-TV brand could alter this outcome.

- Based on these factors, Alibaba is facing a ready supply chain to introduce its free TV if the company really wants to do so. The question will be whether this is good or bad for the entire LCD TV supply chain.

A free TV would definitely threaten many traditional TV players. TV brands are selling their smart TVs for the brand value and the hardware, but a free TV represents a totally different business model where the TV is seen only as a tool to promote other services, such as e-shopping.

For TV panel makers, this could be beneficial, as replacement demand will speed up, and makers like Alibaba will not tie TV set prices to panel prices as tightly. We could assume that the TV product lifecycle would shorten and supply chain players that are selected for this program would see faster turnover in shipments.

Possible features of the Ali-TV

So what would the Ali-TV feature? It seems possible that the Ali-TV could be a large flat panel display (40”+) with 4K resolution (60Hz/T-Con & MEMC integrated) and most of its hardware already in the box, independent of the display.

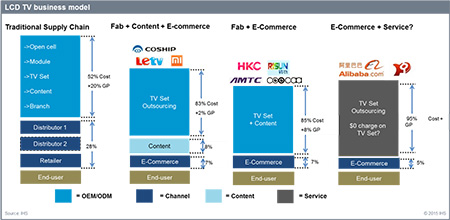

The smart TV concept has been evolving for years. Some consumers recognize a need for a TV with a superior display and great picture performance, so they are willing to pay the premium. Some are looking for a monitor that just needs to be big and cheap enough. With the possibility of a free TV introduced by an e-commerce provider, we may see a new type of TV that combines the hardware, platform, content, terminal, advertising, apps, and broadband. The cash flow would result from the software, whereas the hardware is just seen as the carrier for the software. This could bring another wave of change to the TV and display industry, as shown in the following figure.

This blog was reprinted with permission from DisplaySearch and originally appeared here.