The Status of ProAV, As Told By AVIXA’s “COVID-19 Impacts to ProAV Businesses” Webinar

Last week, AVIXA (the Audiovisual and Integrated Experience Association) held an important and data-driven webinar based on consolidated findings from the past 12 weeks of its Impact Survey — a weekly assessment of proAV industry trends, attitudes and perceptions in light of the pandemic. The “COVID-19 Impacts to Pro AV Businesses Webinar,” available to AVIXA members, sought to summarize almost three months’ worth of data from two main groups in the AV industry, providers and end users.

Each week, AVIXA gets about 300 responses on its surveys — largely from providers like AV integrators (two-thirds of respondents) and end users like higher-ed technology managers (one-third of respondents).

Kathryn Harvey Lawless, manager of program design at AVIXA, kicked things off with an introduction, then handed it over to Sean Wargo, AVIXA’s senior director of market intelligence. Here are some learnings from the webinar, in case you missed it.

Times Are (Still) Tough, But Industry Impacts Could Be Lessening

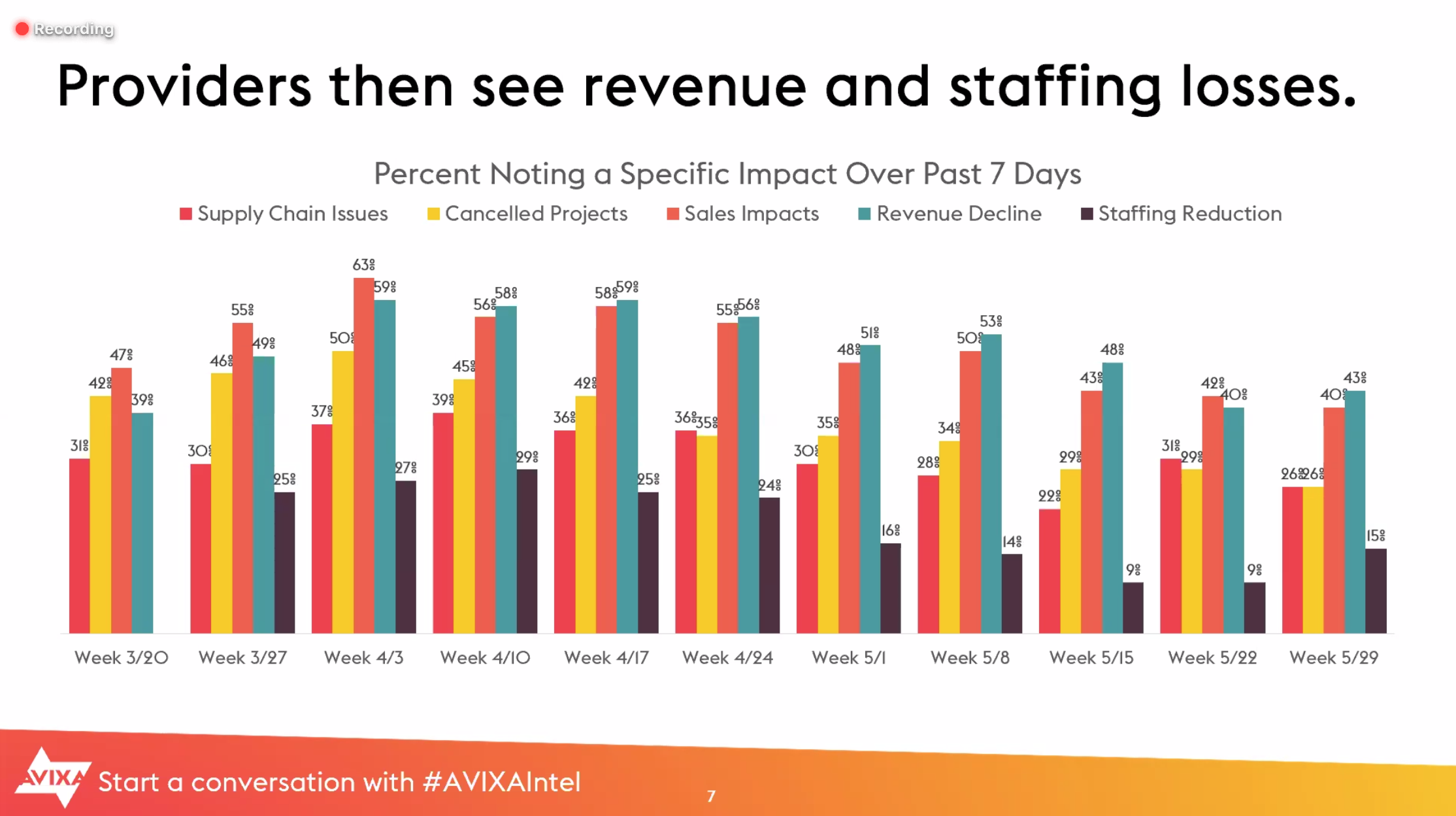

While industry impacts appear to be lessening, Wargo started, a large percentage of survey respondents are still reporting negative impacts (57% of end-user respondents; 66% of provider respondents) as of week 11. This excludes live events, which was at almost 100% negative impact week after week. Wargo added that these figures make sense in hindsight — some of the most pronounced impacts happened early on, with end-user companies such as higher-ed institutions putting a delay or eternal hold on projects and orders not needed immediately when the pandemic hit. From those cancellations, providers saw revenue and staffing losses — with a clear pipeline impact from end-user cancellations, this flowed to the providers who had to put work on hold until there were reopenings, the economy improved and projects kicked back up.

Below, you can see the breakdown across supply chain issues (red bar), canceled projects (yellow bar), sales impacts (orange bar), revenue decline (teal bar) and staffing reductions (purple bar). AVIXA notes a specific impact over seven-day periods. These numbers make everything feel quite real, with, for instance, half of providers in any given week seeing a decline in revenue. There is a persistent decline and a sizeable contraction in our space, no doubt.

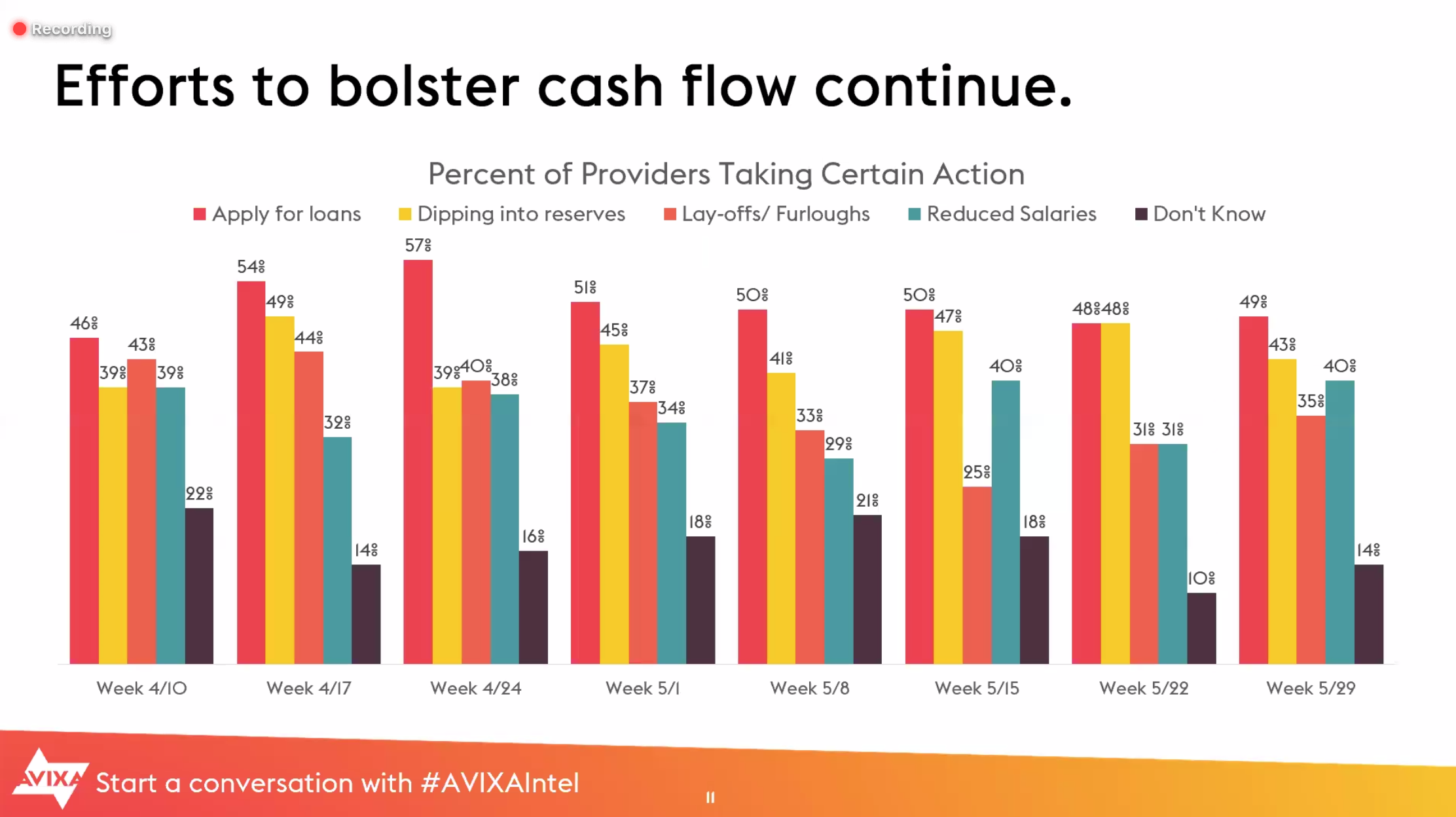

Given that revenues are slow and cash flow is hard to come by, Wargo said, our mode of thinking has been how to make our way through this gap and how. Here, AVIXA’s data revealed the percent of providers taking certain action — applying for loans (red bar), dipping into reserves (yellow bar), doing layoffs or furloughs (orange bar) or reducing salaries (teal bar). About half of U.S. providers have sought or are seeking government loans and/or dipping into reserves. This data looks a bit different than the previous chart — about a third of respondents here are telling AVIXA an action they may have to take is to reduce staff. You can see that reduced salaries are also consistent as the weeks carried on.

All this said, Wargo explained, reported data also shows industry impacts appear to be lessening since March, even if slightly. This could be because economies are reopening and projects are (slowly) gaining speed. While Q2 looks to show declined revenue, we see some optimism about a better result in Q3. That said, we’ll likely be in this generally downward state for quite some time. It’s tough to say we haven’t turned a corner yet, Wargo expressed, but we look forward to the day when we can. Furthermore, we’ll need to look at how much of this is permanent versus temporary. “If it’s furloughed, that’s good news,” Wargo stated. He continued that furloughed means the decline is not of permanent nature and, perhaps, only a temporary one, with work and projects to hopefully return soon.

Businesses remain in varying states — of course, there’s piqued interest for UCC technologies and for redesigning spaces in light of safety guidelines and working from home. If predictions hold, Wargo said, we could see a healthy resumption of project work. Some pipelines are reopening, and many are still open for business but at a reduced capacity. The longer cash flows are suppressed, however, the harder it is to remain. Companies are doing their best to add new capabilities, look at a new company structure, etc. to stay afloat.

Is the Outlook Positive or Negative?

The answer is sort of both, and it depends on who you ask. The hard part about forecasting in our space, Wargo added, is that it requires assumptions — and timing is everything.

When asked, “When do you think the bulk of projects will return?” the data shows that our industry has optimism — a quarter of respondents thought projects would even resume in May. As phased reopenings were announced, things started to shift and realities set in that, perhaps, that wouldn’t happen so quickly. But AVIXA’s survey respondents are still optimistic for returns in June and July. Most providers, Wargo noted, are looking to the August and September timeframe.

Wargo talked about 2020 global figures later in the presentation when talking about ProAV as compared to GDP. As an industry, we tend to look a lot like GDP but are perhaps now a little worse off. He shares that, in 2020, Europe is expected to be a bit harder-hit as compared to the United States. APAC has been the most controversial, as there’s disagreement around how much of a blow there has been to the Chinese economy. For these global figures, we will need to stay tuned as more data comes in.

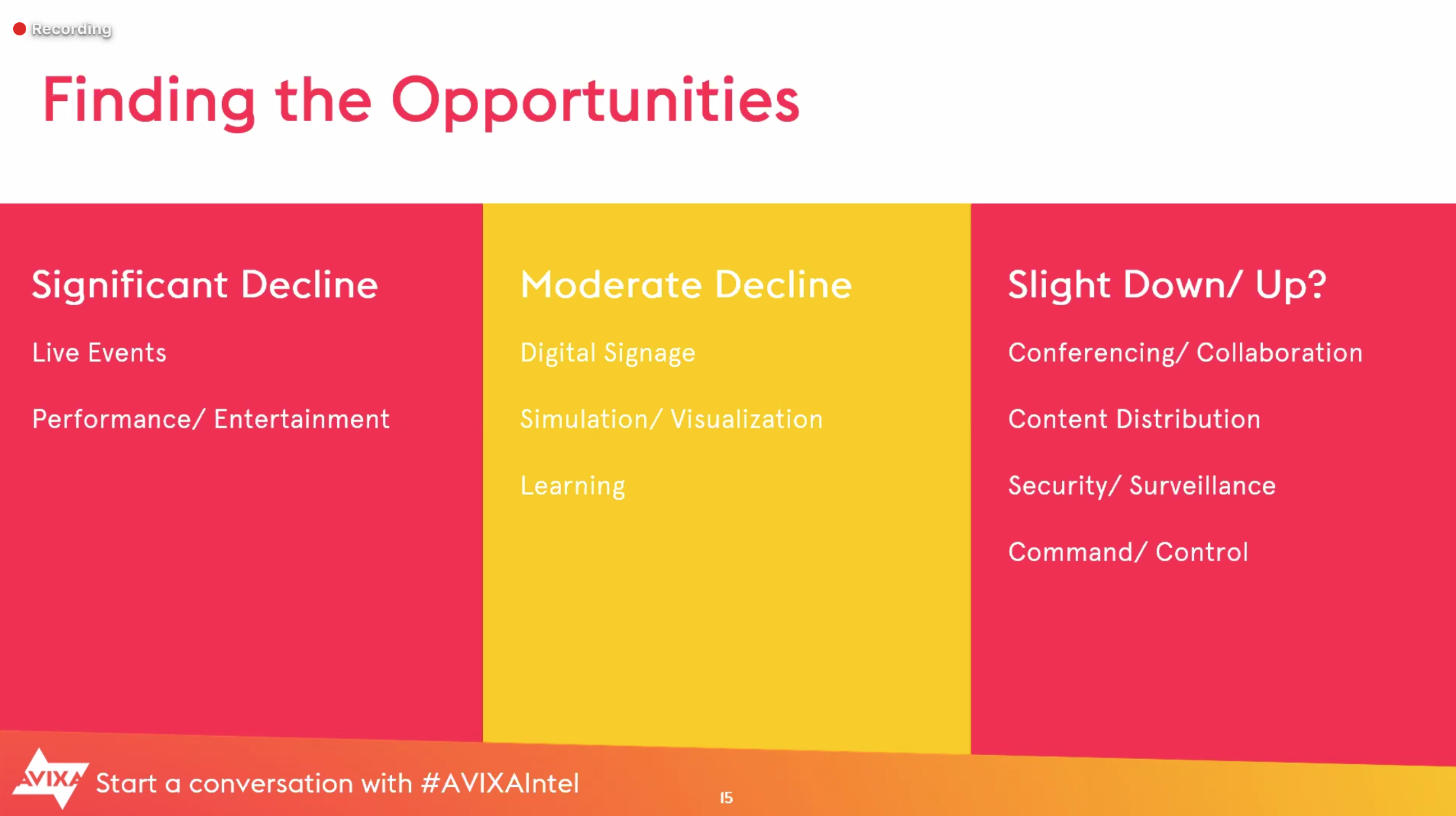

Wargo added that it’s about finding the opportunities. Here’s how he breaks out a few industry categories:

It’s worth looking into potential areas of growth, but that’s not to say you should redo your entire business model. Wargo added that there could very well be pent-up demand as some of these move out of the “moderate decline” phase and back into regular project work (take, for example, the pre-coronavirus growth of large-format direct-view LED displays in event venues — those could come back around). A lot of this is also based on the confidence of the consumer, which makes it a bit of a question mark. That said, ProAV has always tried to find new ways to create experiences, as we know we live in an “experience economy” and are always thinking about how to make in-person and at-home experiences exceptional with technology. Our industry can play a role in how we capture and deliver content, and experience does not go away, even if it does change.

Takeaways & Resources

AVIXA’s webinar was a holistic look at COVID-19’s impact on ProAV over the last couple of months. This is the data we need to better understand the effect on the industry and areas for improvement. I appreciated the breadth and specificity of the data and the breakdown between providers and end users. The one thing that I, and others watching the webinar who mentioned this, would like to see now (and Sean even spoke to this himself as he recognizes AVIXA’s membership is predominantly from North America) is more global data that reflects the impact outside of the United States. That said, to do this, AVIXA will need its members’ help recruiting more international members and garnering responses from across the globe; to be able to uncover trends from country to country, AVIXA needs more survey responses outside of North America. Wargo shared that one way to help is to participate in these surveys and join the association’s Insights Community at avip.avixa.org.

For your context, here’s a round-up of AVIXA’s week-over-week findings from its Impact Surveys so far. Survey results are released every 7 days.

Week 1 — March 20

Week 2 — March 27

Week 3 — April 2

Week 4 — April 9

Week 5 — April 17

Week 6 — April 24

Week 7 — May 1

Week 8 — May 8

Week 9 — May 15

Week 10 — May 22

Week 11 — May 29

Week 12 — June 5*

Week 13 — June 12

*Note: the date of original posting was June 5, though the AVIXA article now notes June 12

AVIXA also has some additional complimentary resources on COVID-19’s impact on ProAV here.