As TV Makers Exit Plasma, Can They Make Up For It With LCD?

By Ken Park

DisplaySearch

The recent announcement by Samsung SDI that it will end plasma display panel (PDP) manufacturing this year also speculated that LG Electronics will shut its PDP business due to low demand, which would leave COC (Changhong) as the sole remaining plasma TV manufacturer. Earlier this year, NPD DisplaySearch predicted the demise of PDP TV; our most recent forecast is for shipments of 0.5M in 2015, down from 5.2M in 2014 and 10.3M in 2013.

Nevertheless, PDP TV demand was not bad in Q1’14, coming in at just under 2M units globally, higher than our forecast, with exceptional growth of 164 percent Y/Y in Latin Amercia. While the Latin America TV market has grown rapidly due to the World Cup, PDP has actually increased its share of the market from 5 to 10 percent over the past year. In large part, this has been due to Samsung’s PDP TV shipments, which, in Latin America, have grown faster than its LCD shipments; the same is true for LGE. Samsung’s Latin American PDP TV shipments of 475K in Q1’14 is comparable to Sony’s LCD TV shipments (556K units) to that market. Thus, in markets such as Latin America, Samsung will need to make up for a potential loss in market share.

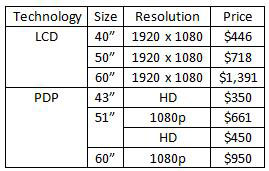

However, as shown in the table, Samsung’s current LCD TV lineup does not match its PDP TV lineup in terms of pricing in the three key PDP sizes (of course many consumers prefer LCD technology even at higher prices).

Selected Samsung TV Prices, May 2014

Source: The NPD Group Retail Tracking Service

In order to capture the demand for the lower-priced PDP TVs, Samsung will likely develop price-competitive LCD TV designs. Our supply chain research indicates that new 40” HD, 48” HD, and 58” FHD LCD TV models will be ready in the next few months, and we expect them to address this challenge. While the general market appears to be driven more by pricing than display technology, Samsung will still need to manage the transition from PDP to LCD TV in order to avoid a big loss in market share. Panasonic has not been able to replace its loss of market share with LCD as it exited PDP (though it is showing signs of life in commercial LCD), although it was much more dependent on PDP and not a leading brand in LCD TV as Samsung and LGE are.

This column is reprinted with permission from DisplaySearch and originally appeared here.