OVAB Europe Digital Signage Business Climate Index

The OVAB Europe Digital Signage Business Climate Index was launched in Scandinavia with the May-June 2015 issue. On a scale from -100 to +100 base points the index stands at 66,65 points. This very positive rating reflects the good business sentiment of the Digital Signage industry. I believe it [the DBCI] is highly relevant for the industry as such, to have some more reliable data to build around their business,” says Frank Larsen CEO of Digital Experiences Nordic.

The OVAB Europe Digital Signage Business Climate Index was launched in Scandinavia with the May-June 2015 issue. On a scale from -100 to +100 base points the index stands at 66,65 points. This very positive rating reflects the good business sentiment of the Digital Signage industry. I believe it [the DBCI] is highly relevant for the industry as such, to have some more reliable data to build around their business,” says Frank Larsen CEO of Digital Experiences Nordic.

After the financial crisis in 2008 only in Norway the Digital Signage and Digital-out-of-Home industry could keep up the pace. However, since the end of 2013 also the general economy in the other countries (Sweden, Denmark, Finland & Iceland) has gathered momentum. Creating a positive knock on effect for strategic investments in the digital transformation process. Mr. Larsen sees that: “Retailers and corporates are again willing to invest in a better customer experience with Digital Signage solutions.”

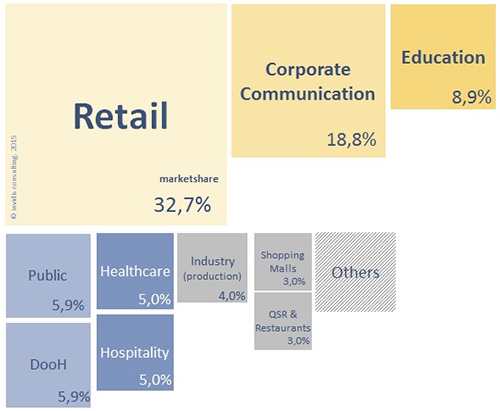

The vertical markets of Retail, Corporate Communication and Education were the Top 3 markets for Digital Signage related products and services in 2014 (measured in number of projects)

Retail is with approximately one third of all Digital Signage revenues the biggest vertical market. Customer engagement, marketing and ambient installations become more and more common not only in most high-street retailers, but also in small and medium businesses. Important trends are full integration of monitor systems by shop fitters and the high demand for shop window signage.

In particular, the corporate communication vertical market has grown exponentially over the last few years. With rising IT budgets, the digitization of employee communications is now seen as a sustainable investment by many companies.

Education is the third biggest vertical market in Scandinavia. The trend towards the digital / paper-less communication in universities and schools has increased the digital transformation in western societies. Particularly in Scandinavia this trend has already resulted in a high Digital Signage penetration.

The market participants have again underlined the high importance of the small-and-medium business (SMB) market for Digital Signage. Three qua rters of all Digital Signage projects in 2014 were installations with up to 50 displays. Smaller projects have a higher margin and can be carried out successfully by most players in the market. Also the falling hardware prices created a high demand for easy-to-use Digital Signage solutions in the SMB sector.