InfoComm: Global AV: Spotlight Europe

By Monica Heck

Special to InfoComm International

[Editor’s note: In 2015, InfoComm International will offer snapshots of AV markets around the world, based on InfoComm research and interviews with AV professionals in those markets. Look for future global spotlights in the Resources section of our website.]

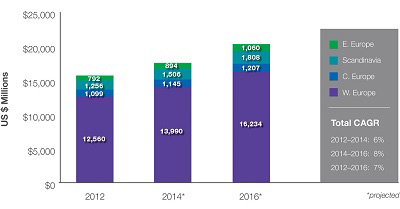

As AV professionals prepare for Integrated Systems Europe 2015, Feb. 10-12 in Amsterdam, they do so in business environment characterized by good and average news. The good news is much of Europe is well into its emergence from a challenging recession and its $17.5 billion pro AV market is positioned for growth over the next couple years, according to InfoComm International’s 2014 Global Market Definition and Strategy Study (MDSS). The not-as-good-news is that growth across the continent is expected to lag behind other regions of the world and won’t be uniform throughout the continent.

As AV professionals prepare for Integrated Systems Europe 2015, Feb. 10-12 in Amsterdam, they do so in business environment characterized by good and average news. The good news is much of Europe is well into its emergence from a challenging recession and its $17.5 billion pro AV market is positioned for growth over the next couple years, according to InfoComm International’s 2014 Global Market Definition and Strategy Study (MDSS). The not-as-good-news is that growth across the continent is expected to lag behind other regions of the world and won’t be uniform throughout the continent.

According to the MDSS, the market for AV products and services in every major region in the world is poised to grow 10 percent or more between now and 2016; in Europe, that growth is pegged at about 8 percent. Drilling down, the Scandinavian region of Europe, for example, is expected to grow 10 percent, while Central Europe is only expected to grow 3 percent (see chart; © InfoComm International 2014).

Still, growth is nothing to sneeze at — and even 8 percent growth makes other segments of the economy pale by comparison. The growing AV market shouldn’t be confused with the economy at large, which recently has faced fresh headwinds. And while the AV industry in Europe seems to outperform the larger economy, there are pockets of market pressure that may account for slower growth than in other parts of the world. Even so, the dynamics that AV pros experience in one part of Europe may not be the same as in other parts.

“Things get relative when you look at them on a granular country-to-country level,” says Godwin Demicoli, CTS®, InfoComm’s regional director for Europe. “We are still lacking recovery and growth in certain areas, such as Italy, for example, but a country like Poland is showing strong growth.”

The MDSS found that Western Europe accounted for about 80 percent of the European pro AV market in 2014. But even there, in the northern countries — primarily the UK, Germany, Benelux (Belgium, the Netherlands and Luxembourg), Ireland and Austria — the AV market is growing faster than in the southern region, which includes Portugal, Spain and Italy. France, according to the study, is caught somewhere in the middle.

But such numbers aren’t the only gauge of European markets.

“Scandinavia shows steady growth, the UK is a more mature market with a strong economy, as is Germany,” says Demicoli, who is based in Germany and travels throughout EMEA talking to InfoComm members and others. “Spain is coming out of its trough; Portugal is actually looking ahead when it comes to recovery. Greece is showing a strong economic recovery and there’s lots of optimism.”

From within various European markets, AV pros have their own perspectives:

- In Poland: “[The market] is so active at the moment we’ve discussed leaving some of our corporate vans at the airport to save time and money because we’re spending so much time there,” says James Shanks, AVI-SPL’s managing director for EMEA

- In Germany: “I don’t see a fall or growth in any direction. Right now we simply see steady activity in the corporate and education spheres,” says Jan Röder of German systems integrator VST GmbH.

- In Ireland, where the market has started to bounce back: “The business didn’t just disappear; people were just clever in the way they were spending their money, looking for better value, better service,” says Adrian Back, senior technical sales specialist with SI Eurotek. “It became more competitive, there was money still being spent but you had to do more to get business.”

Overall, those in the region acknowledge the European AV market is fairly mature, after a stretch in which many organizations invested in AV systems. With a contingent of early adopters across the continent, a level of technology saturation may be expected. Customers who are still spending may be transitioning from an early adoption mentality to a focus on ROI.

“From a Northern European perspective, the investment per headcount within business has generally been higher over the last 10 to 15 years than possibly other areas of the world,” says Shanks. “Because of the maturity of the European marketplace from an audiovisual, videoconferencing and integration perspective, it’s very hard to sustain such large growth levels consistently.”

Corporate Strength

Recession or not, European corporations have continued to invest in AV technologies. Overall, the corporate market is by far Europe’s largest — $5.6 billion in 2014. It’s also the fast-growing, poised to hit $6.6 billion in 2016.

Such corporate AV growth is not enjoyed throughout Europe, but it is a positive indicator. According to the MDSS, France’s and Southern Europe’s corporate sector are not growing as quickly as other regions because businesses there have been less likely to invest in AV due to economic and/or political uncertainty. But in some cases, that can present an opportunity, as companies turn to technology to operate more efficiently.

“Certainly, the corporate market was seeking more efficiency in its own operations,” says Back. “Technology can help, so that market was still active during the recession, looking for value and ROI. Those companies were investing, but being careful of how they spent their money.”

The types of environments in which corporations are willing to invest have expanded. AV pros say multipurpose, flexible “huddle rooms” are becoming increasingly popular in the European corporate market. In a related trend, European AV firms are seeing greater demand for unified communications technology.

“Unified communications is a good buzzword,” says Back. “Not everyone understands what it means, but in terms of a challenge to integrators, there’s a lot of extra thought that has to go into designing the solution for the corporate meeting room space.”

Display Applications Drive Growth

According to the MDSS, video displays make up the largest product segment in Europe, accounting for 22 percent of the market and growing 8 percent from 2012 to 2014. By 2016, displays in Europe are expected to reach nearly $3 billion in sales.

In general, display sales in Europe remain strong as customers continue to purchase larger sizes with higher resolutions. But applications of video displays are also driving the market.

“From a displays perspective, the big European opportunities are in the education market, especially with interactive flat-panel displays,” says Ben Davis, market analyst at UK-based Futuresource Consulting. “We’ve seen, over the last couple years especially, that the UK [education] market is transitioning from interactive whiteboards to interactive flat panels.”

In fact, says Davis, the evolution of connected, “smart” classrooms is driving trend, particularly in Benelux and Nordic regions of the continent. And in areas where the AV market is more mature, connected classrooms could provide the engine that keeps the AV market growing.

“It’s an area we are seeing huge growth in at the moment in those more developed markets or among these early adopters of interactive technology,” Davis says. “We expect that to proliferate across the rest of EMEA, specially the rest of Western Europe, over the next couple of years.”

However, at least one AV expert suggests caution in companies’ approach to new technology. For instance, ultra-high resolution may not be customers’ most pressing requirement, especially at a time organizations worldwide are more focused on ROI.

“We only just got used to things like HD and now they are being railroaded into 4K, which can be a waste of money for some applications,” says Robert Simpson, founder director of systems integrator Electrosonic. “It’s the kind of thing that will make people hold back on investment. Quite aside from the technical implications we are there to solve.”

AV-IT Challenges and Opportunities

Clearly, one of the most significant technical implications that AV professionals worldwide must manage is the intersection of AV and IT technologies. European AV firms are struggling with that merger like companies elsewhere in the world.

“Certainly, we find ourselves more and more involved in IT infrastructure, it’s not about hardware only anymore it’s an awful lot more about software,” says SI Eurotek’s Back. “Because a lot of the systems are now overlapping with the IT industry, AV support has to match the level of IT support that customers would traditionally have received. So although we are providing an AV solution, we find ourselves also supporting software applications and other IT networking equipment that traditionally would have fallen under an IT system.”

Says Röder, “Honestly, I’m slightly afraid that the pro AV could become diluted in the IT world. As pro AV integrators, we have to look for new markets, as well as customers who need systems and integrators with our knowledge and skills.”

The silver lining in AV-IT convergence is that it leads to new applications of technology that AV professionals can design, sell and enable. Electrosonic’s Simpson expects AV companies throughout Europe to explore developing markets within and outside their existing areas of expertise.

“Internal markets include a new and emerging class of users who didn’t previously use AV, but must now as their workforce has adopted tablets and other technologies,” Simpson says.

Ultimately, Simpson sees a pro AV market that is cyclical worldwide. “From our narrow perspective focusing on big corporate and entertainment projects, we may have finished a year where the market might have been a bit thin in the UK, but good in the U.S. and the Middle East,” he says. “But that’s not to say the work has gone away forever; it will come back.”

In the meantime, according to InfoComm’s MDSS, although there considerable upside to the economic outlook for Europe, adjustments should be made.

“Pro AV firms will need to continue to offer ways for customers to achieve higher return on investment and value for their [money] for AV system purchases,” researchers concluded. “AV is competing with many other areas of needed refurbishment and replenishment as Europe emerges from economic doldrums.”

Order your copy of InfoComm’s 2014 Market Definition and Strategy Study, including results focused specifically on the European market.

This column was reprinted with permission from InfoComm International and originally appeared here.