The Cost of Late Adoption: Mitigating Risk

After I wrote The Cost of Late Adoption last month, I received quite a few comments, Tweets and DMs around the topic. Gary Kayye even did a Rants and Raves on the topic, drawing parallels to the book Crossing the Chasm, one that I have to sheepishly admit that I’ve never read.

To tell the truth, the part of writing that I love the most is the potential to generate additional conversations around the topic and perhaps explore new ideas together. There were a few comments or questions I received about risks involved with adopting technology early, and it would not be intellectually honest of me to say that there are not any risks at all. However, I think there are some practical ways to mitigate those risks, and if that is done properly, the benefits of jumping the technology curve early far outweigh the cost of waiting.

There were a few major themes in the comments I received. Those centered around new products and their potential to be delayed or discontinued, format wars in new technology, client education, and more data from other sources to help reinforce the original premise that adopting early gives an edge to profitability over the life cycle of the product.

Products vs. Technologies

If there is one concept I want to drive home it is this one. There is a huge difference between a product and a technology. In an industry like ours, where every InfoComm yields hundreds of new product announcements, it is easy to get caught up in product releases.

New products are not new technologies.

New products may employ new technology and that is what we need to watch for. Some of those technologies will have greater implications, and some will not really matter at all. You really need to look at how the technology affects the ecosystem as a whole.

Look at the display market. LED is a technology that was employed to back light LCD displays as opposed to the incandescent lamps of the previous generations. The displays became thinner, more efficient, and slightly lighter, but didn’t have any real impact on the ecosystem. The connections were the same, weight and VESA were still the de facto specs needed to mount them on the wall and signal extension was the same as it always was. Adopting LED-backlit LCDs over traditional LCD screens conferred no real advantage to businesses in general.

Now look at OLED. On the surface, replacing the LED lights and LCD panel with an OLED seems to offer only incremental improvements in power consumption and display weight and thickness, just like the example above. But looking deeper, OLED is a film that can be applied like wall paper, making mounts an unnecessary part of the install. They can be transparent, opening the door to new unique applications. They also have an enhanced color space and better contrast ratios, opening the door for the propagation of Wide color gamut and HDR video signals that will require distribution and management of higher bandwidth video signals. If you don’t think getting a jump start on your competition when it comes to these things is important, then you’re just not seeing the big picture.

So as you see above, there are two examples of product introductions, both employing new technology inside and one had little impact on business processes and design methodology while the other could have large implications.

Now the product you specify may be delayed or not come to market, but the investment in gearing up for the technology on the whole is not lost. There is always the risk that a product is discontinued or changed slightly from its prototype before being shipped, whether the tech inside is new or not. That is just the nature of the industry.

If you focus on technology not products, and then look at the potential impact on the ecosystem as a whole to know where to focus your larger adoption efforts, you can avoid a lot of risk in the process.

Format Wars

There were a few comments that asked,

“What if we choose wrong?”

Sometimes in technology, early on there are competing ideologies. Commonly cited examples are: VHS vs. Beta, Blu-Ray vs. HD-DVD and HDBaseT vs. Video over IP.

First you have to ask: Does it matter who wins? In case of VHS vs. Beta and BluRay vs. HD-DVD, when it comes to running an integration business, it really didn’t matter. The connectors, video transport methods, extension concerns, signal bandwidth, etc., were all essentially the same. The only person it really mattered to was the end user, as they had to invest in media stored in one form or the other. As long as you did your due diligence as integrator and offered either or with a disclaimer that you didn’t know who would emerge, it didn’t affect system design.

Think of an install you did with an BluRay player and then ask how that would have been materially different than one done with an HD-DVD player. Other than the control codes, everything else would be essentially the same.

Again the technology implications of BluRay and HD-DVD were the same. As were those of Beta and VHS. As are those of OLED and Quantum Dot in today’s world.

So sometimes the answer to, “Which do I choose?” is: It doesn’t really matter.

What about HDBaseT vs Video over IP?

HDBaseT, if nothing else, is a great point-to-point solution that eliminated a lot of the HDMI extension issues in the industry. It does however offer robust switching capabilities as well, and major manufacturers in the industry have adopted it as their core method of signal transport. There was an early mover advantage to adopting this technology and being among the first to manage the routing and extension of digital signals, EDID and HDCP.

Some may then ask, “Why also invest in Video over IP?” To get a good feel for the debate, check out this podcast, but in short, look at other technology trends at work. You’ll see cloud-based VTC and content for digital signage, IP based audio routing like Dante and AES and a tidal wave of connected devices entering the fray. Why wouldn’t you be investing in IT skill sets that allow you to know how to set up level 3 switches, set QOS parameters, create VLANs, etc.? Investing in Video over IP opens the door to video distribution across the LAN and WAN and easier, more cost effective, per port distribution of signals as well.

Even if HDBaseT fulfills all of the promise of its 2.0 spec with regards to interoperability and addressability of devices and becomes the de facto video transport standard for copper and fiber based networks, the IT skill sets built in adopting Video over IP will be of use in several other areas of the business. However if HDBaseT does not fulfill that promise, and you are not moving early on IP transport, where will your business be in five years? Where is the greater risk?

In this case, the answer to “Which do I choose?” is really: both.

I can’t cover every scenario here, but as you can see, the answer to the format wars is in applying the same product vs. technology logic above to properly assess where the impact to the business is and proactively mitigate that risk.

Market Education

One comment I received on the last blog was from Bob Nichols.

“Early adopters will need to spend time and money educating the market about the new product or service. How much of the extra profit is invested in these efforts?”

I first want to say it’s a great question and the answer is, of course: It depends.

In many cases, little to no investment is needed at all. They may not really care how you are moving video from point A to point B, they just want it to get there. You have to remember a common saying:

“People don’t want a drill, they want a hole.”

If you’re in the business of selling cutting-edge video distribution, then that could mean HDBaseT today, Video over IP tomorrow and direct wireless video uplink to the optical nerve in 10 years. My point is the need drives the request and the technology is just the delivery. That delivery can be discussed just like every other part of the scope in your needs assessment or in the presentation of your system’s bid. There is no need for a special Apple-esque product introduction and advertising.

Now if you just respond to RFPs, and you don’t typically do needs assessments or bid presentations like a design-build firm may, then you don’t have that opportunity. However if the product is on the RFP, someone else already did that education.

In our industry, the trend currently is that more and more manufacturers are tackling the job of new product education. They are creating whitepapers, landing pages, campaigns and using teams that reach out to consultants, specifiers and technology managers to drive product demand at that level and then translate that interest into leads and introductions for their integrators. Partnering with manufacturers like QSC, Milestone, Harman, etc. that are out there investing in mind share for their product categories can be a great way to offload a lot of the cost of client education.

As a closing point, there is always a varying level of education that needs to be done with a client, regardless of the product or its stage in the product cycle. You may be working with a technology manager that has bought a thousand AV systems or a CEO who has 10 employees and just formally moved from the garage to an office. They will need varying levels of education on your proposal and its components. That’s just AV.

Extended Thoughts

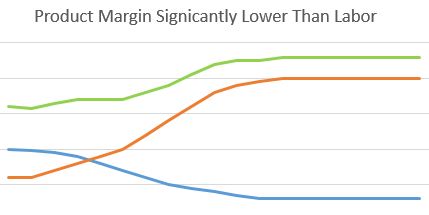

I thought I’d offer a few extended thoughts on the profit curves as they relate to product and labor margins.

The “S” curves used are fairly intuitive and I created my own, but they are commonly used in economic theory across products and industries. Of course those curves can have greater amplitude (y-axis) based on price points or a varying time frame (x-axis) based on pace of adoption. Given that, there is a potential exception to the early adopter advantage I laid out in the previous blog.

Low Priced Technology

When it comes to profitability, products that have a very low price point to start will be ineffective at leveling out the combined profit curve if the labor costs initially are disproportionately high. Even though margins may be high, the price point is so low that the margin dollars do little to level out the profit curve.

As Martha Brooke once told me back when she was with Monster Cable,

“My bank doesn’t take margin, it takes dollars.”

When you reduce the price of a product, keeping the labor cost curve the same, the resulting profit curve looks like this:

(Product Margin Curve — Blue, Labor Margin Curve — Orange,Combined Profit Curve — Green)

In these cases, the benefit to early adoption is less and the cost of waiting is reduced greatly. There may even be a benefit to waiting in these cases.

The point is that the larger the price tag on the new technology, the less risk you assume in adopting it early. As that price tag decreases, the early profit curve becomes more of a climb to profitability.

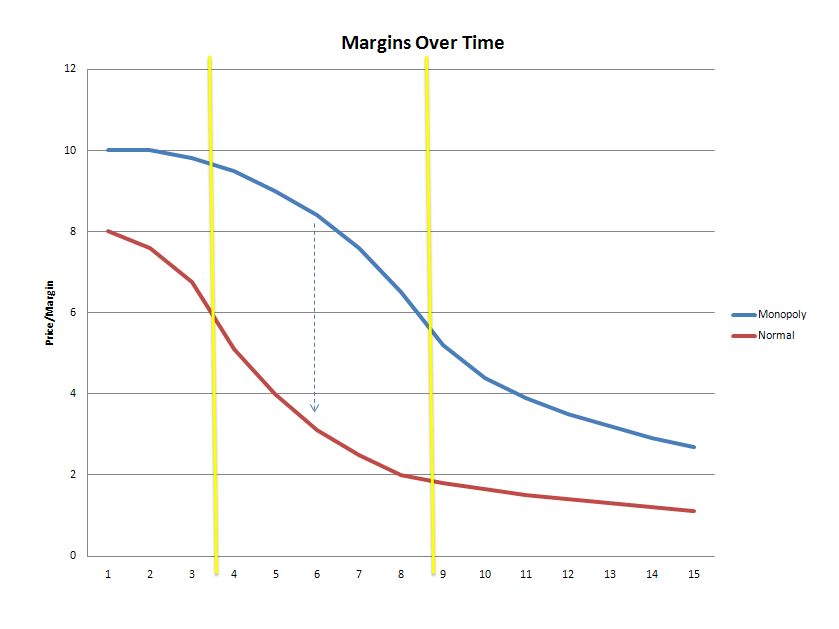

Sometimes a manufacturer is first to market and has a temporary monopoly. We saw this with HDBaseT. Crestron and Valens teamed up on the original DigitalMedia product before other HDBaseT partners were able to start selling their products. In that case, the price points were higher due to the monopoly. However, because it was a single vendor solution, the risk may NOT be necessarily lower, because if the vendor cannot deliver, there is no alternate to switch to.

As the monopoly dissolves, there will typically be a jump to the lower open market curve. Profitability drops somewhat as well, but the risk is now in check as alternate solutions exist if in fact a single vendor fails.

The moral here is that a monopoly can be a double-edged sword in regards to the risk of early adoption. If they deliver, everyone makes money, if they don’t everyone loses.

So to summarize:

To mitigate the risk of being an early adopter first recognize the difference between new products and the actual technologies behind them. Look at the ramifications of those technologies to the industry to determine their potential impact to business and installation practices. Evaluate competing formats and determine whether who wins is even relevant and then adopt a strategy to adapt to the underlying technology ramifications of one or both. Partner with manufacturers focused on investing in end user education about technologies and become part of their execution strategy for delivery of new products. Finally, understand that technologies with relatively low price points but high labor costs may not confer the same advantages, and that single source solutions, despite the price, may still confer some risk depending on the manufacturer’s history of sound delivery.

In any case, if your company doesn’t have someone whose job is to evaluate emerging technologies and create potential business plans around them, you may want to invest in one!

Comments? I’d love to hear them below!