AVIXA Study Shows $9 Billion 2020 Drop in ProAV. But, They Forgot to Track Something Positive

After reaching $93 billion in 2019, the Americas ProAV market is set to drop 8% to $86 billion in 2020 due to the COVID-19 pandemic, according to the new 2020 AV Industry Outlook and Trends Analysis (IOTA) Americas Summary produced by AVIXA (the Audiovisual and Integrated Experience Association). However, a strong recovery is expected, with growth resuming in 2021. In 2022, revenue will rise to $95 billion and reach $108 billion in 2025. But, this is all “traditional” AV — this is what its report tracks. Keep reading — as there are a host of elements that aren’t being tracked that provide ample opportunity for growth.

“AVIXA’s latest forecast was formulated in the first half of 2020 and is based on the assumption that market growth would return in the second half of the year as businesses reopened and resumed purchases of ProAV products,” said Sean Wargo, senior director of market intelligence, AVIXA. “Our forecasts show that a lot of the ProAV products and services that were already trending upward — servers, digital signage, security, conferencing, and collaboration — will pick up more steam because of the pandemic’s impact.”

The 8% COVID-19-related drop in the Americas ProAV revenue in 2020 closely aligns with the global decline of 7.7% in 2020. However, the Americas will perform better than the Europe, Middle East and Africa (EMEA) region, which is set for an 8.9% decline. In contrast, the Americas will underperform Asia-Pacific, which will decline by 6.4%.

However, we think the study is flawed in that it isn’t tracking the massive increase in “services” related to the “Work-From-Home” culture that COVID-19 created and new software tools being integrated. AVIXA’s forecasts are completely accurate with respect to hardware but, with respect to software and services, it’s not being counted. For example:

- BLUESCAPE is providing cloud-based collaboration solutions for hundreds of thousands of ProAV customers that didn’t exist before COVID-19.

- The accelerated adoption of cloud-based AV solutions will likely make 2021 a record year again. Crestron, Barco and Kramer already have solutions but watch for some giant rollouts of CloudAV options in early 2021.

- AVaaS has exploded since March, and even hardware companies have added it — like HaaS from Zoom. This isn’t being counted in the AVIXA data.

- AV management solutions, like AVinsight from TierPM, are not going to be options for higher ed, corporate or healthcare AV solutions anymore. Adoption has already been accelerated.

- Logitech, VDO360 and MXL are having record years with their UCC solutions.

- Intel’s Unite platform is seeing record interest and specified systems.

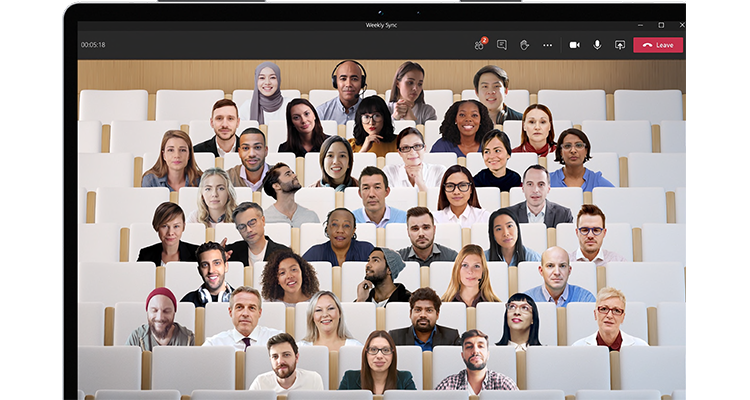

- UCC is no longer defined as meeting-room-based. All of a sudden, UCC adoption is everywhere, and if you’re integrating Zoom, Microsoft Teams or BlueJeans, you’re making a fortune in healthcare and education.

- Finally, digital signage: Wow, what a year for signage — every signage vendor is UP due to new social distancing protocols and the need for temperature scanning devices. Kudos to LG, Peerless-AV and Aurora for jumping on this for the AV channel.

AVIXA is right, but it needed to simply attach the word “traditional” in front of every reference to the “ProAV market.” The traditional ProAV market is what AVIXA is referring to but, those AV integrators and manufacturers who have been shifting toward leading with services are growing. It’s not that they are taking business away from the traditional AV companies; it’s that the traditional meeting-room-based AV has stalled, but the need for “distributed AV” has accelerated. There isn’t a college or university in the U.S. that didn’t spend between $20,000 and $40,000 upgrading most of its lecture halls and classrooms this summer — even if it didn’t end up holding in-person class this fall — but, more importantly (and this is the key), they are rapidly moving it all — ALL — to onboarding it all onto the network. AV-over-IP adoption will benefit from the COVID-19 pandemic but, AVaaS and managed services will take a giant chunk of the checks written to support these classrooms.

So, why are AV integrator numbers down? Well, they are where traditional AV installs dominated the landscape. But, at companies that pivoted or were already doing AVaaS, cloud solutions, IoT management and software-based solutions, they’re up. It’s created an entirely new market structure in recent years that a select group of companies have noticed — for example, Synnex added a CollabSolv group in early 2020. Little-known Collabtech (where AVIXA’s own board chairperson moved just days ago) only consults in UCC solutions — outside of physical spaces, too. Oh, and have you noticed these new products?

- Microsoft Follows Zoom and Launches Personal Teams Devices for Homes and Offices

- DTEN Introduces DTEN ME

These will all sell remarkably well and aren’t showing up in the AVIXA study, either, yet.

North America accounts for a dominating 87% of Americas regional revenue in 2020 — a share that will largely hold steady through 2025. Although much smaller compared to North America, the South America market will undergo stronger growth, with a compound annual growth rate (CAGR) of 5.6% from 2020 through 2025 — compared to 4.5% for North America. Central America & the Caribbean will attain region-leading growth with a 5.8% CAGR.

Not only is the energy and utility market the fastest growing in North America, it’s also the fastest across the entire Americas region with an 8.5 percent CAGR for 2020-2025. Due to the pandemic’s impact on decreasing travel, demand for oil has dropped, however, the market is expected to rise rapidly as economic conditions improve. This will drive investments in smart-city, smart-grid, with heavy digital signage and control room solutions, translating into considerable demand for LED video displays, which will enjoy a 25.6 percent CAGR.

The fastest-growing industry in Central America and the Caribbean is transportation, with revenue rising at a CAGR of 10.4% to reach $331 million in 2025, up from $201.7 million in 2020. Transportation also drives the ProAV industry in South America – the market will grow at an 11% CAGR from 2020-2025, growing from $511.1 million to $863.1 million. This growth is propelled by transportation hubs’ investments in ProAV solutions to increase health and safety measures.

According to AVIXA, in the Americas, education will suffer only limited fallout from COVID-19 in 2020, with ProAV revenue declining by 2.7% – and a 4% rebound expected for 2021. Given the unknown nature of COVID-19 and the uncertainty around the timing of a vaccine, schools and colleges will continue to invest in remote learning solutions including updates to classrooms in support of livestreaming. This will not only drive software as a service (SaaS)-based distance-learning solutions but investment in remote teaching aid software, connectivity, and cloud and managed services as well.

Media and entertainment is another market that stands out with a moderate 5.7% decline in 2020, followed by a strong 7.4% rebound in 2021. In the COVID era when people are staying at home, the consumption of digital content from mobile apps to TV and gaming has risen sharply – driving demand for associated equipment. The demand for digital entertainment and business content is expected to increase substantially during the forecast years, giving rise to production, storage, and distribution equipment, software, and services.

Although it will generate only a mild CAGR of 2.3% from 2020-2025, conferencing and collaboration will remain the top solution bundle in the Americas. Increased remote working in 2020, along with limited access for installation, will depress the need for on-premise conferencing in the very near term. However, as employees return to work in a limited capacity, AVIXA predicts that there will be even more need for collaboration among on-premise and remote workers. This is expected to push the installations in the second half of 2020. Over the long term, workspace trends moving toward smaller, more flexible spaces and more remote working will help to sustain growth and keep the conferencing solution in the top spot.

The IOTA report is produced by AVIXA in conjunction with Omdia (formerly IHS Markit), a global research firm with specialty across a number of underlying supply chain markets, many of which overlap with the principal components of the ProAV industry. This specialization provides connections with manufacturers, distributors, integrators and larger end user firms that provide and consume ProAV products and solutions. This translates into sources of data that are modeled in conjunction with key macroeconomic data to generate the forecasts shown.

To learn more about the 2020 AV Industry Outlook and Trends Analysis (IOTA) Americas Summary, visit avixa.org/IOTA. Regional IOTA reports for EMEA and Asia-Pacific will be released in August and September. The IOTA Industry Overview, which explores the global trends within the ProAV industry, is available now for purchase.