An AV-Over-IP Update

By Adam Cox

Senior Analyst, Futuresource Consulting

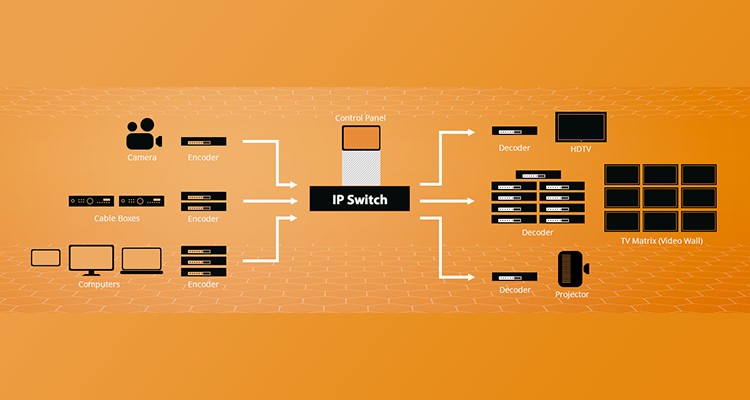

Low-latency AV-over-IP solutions are on the rise across a range of key verticals, presenting clear advantages over competing technologies. Yet, technology continues to struggle to achieve mass-market acceptance. Adam Cox, senior analyst at Futuresource Consulting, explores some of the challenges and takes us through the detail.

AV-over-IP has certainly shown strong volume growth over recent years. In 2018, shipments of encoders and decoders were up 69% year-on-year, followed by another strong performance last year, with growth of 42% expected once the figures are finalized. However, despite the activity, and a continued positive outlook for the market, AV-over-IP has still not achieved widescale adoption. Due to a range of ongoing issues, there is little to suggest it poses a threat to existing extension technologies in low-latency professional AV segments in the short-term.

Factors preventing wider uptake include its price point still being a little high for the market, a lack of networking expertise in the target industries and an underlying reluctance from channel partners to adopt IP. There’s no doubt that volumes are coming through, with vendors reporting significant growth, but at a slower rate than expected. In short, the market is still in its early stages, with end users and channel partners alike unprepared to wholly adopt IP and replace existing non-IP extension deployments.

1G installations continue to dominate, with 10G solutions struggling to find much of a foothold, as market leaders Harman and Crestron have yet to invest in 10G. As a result, the majority of key installations continue to be based on 1G products. Futuresource figures show that 1G accounted for 86% of all shipments in 2019. However, as Extron has now entered the market, offering both 1G and 10G solutions, competition in this segment is expected to grow significantly. Futuresource also expects Extron’s involvement to bring increasing awareness and legitimacy to 10G solutions, though delays with availability have meant a significant impact on overall adoption has yet to be seen.

The USA represents the single largest opportunity for both 1G and 10G solutions, with many brands located in the region and strong volumes being distributed across most verticals. The Middle East has seen some large-scale IP deployments in the oil and gas segment, whereas China has rapidly adopted AV-over-IP solutions across the board. General attitudes to AV-over-IP are less dismissive there, and, with the availability of locally produced solutions, the market continues to grow. As in the USA, leisure and entertainment is an active market, as well as education and corporate verticals. Looking to Europe, the UK and France remain the largest markets in the region, with early demand seen in the retail, corporate and higher education markets.

Although the uptake of 10G solutions in mainstream applications has been slow, demand from high-end critical imaging has been seen, as well as niche applications like esports. Strong development is also apparent in the medical and residential sectors. Still, the bulk of the AV-over-IP market remains in corporate, education and entertainment applications where 1G solutions maintain a significant share. In fact, the corporate vertical is key to low-latency AV-over-IP growth. Businesses are adopting innovative video distribution techniques across meeting rooms and between premises. Despite ongoing threats from the growth of unified communications and collaboration technologies, volumes sold into corporates have grown almost 60% year-on-year from 2018 to 2019 and now account for 30% of total AV-over-IP encoder/decoder volumes. Where IP solutions are being adopted, they are typically being used to transport digital signage content to meeting rooms or other communal spaces. They are also being used as component parts of hybrid deployments, where content is distributed between rooms over IP and distributed in-room by baseband solutions.

In addition to the corporate vertical, the higher education market is also a strong driver of AV-over-IP adoption. The growth in volumes is not only associated with the high demand for video distribution across campuses but also higher education’s increasing need for interactivity and bidirectional communication between multiple spaces on campus and beyond. The number and type of inputs required within and between rooms also varies significantly, making IP the most desirable solution. Also, network backbones are typically more advanced, with IT managers growing increasingly receptive to IP technologies.

Futuresource forecasts indicate that global shipments of AV-over-IP encoders and decoders will rise to more than one million units shipped in 2023, representing a 30% CAGR throughout the forecast period. Although AV-over-IP still lurks beyond the mainstream, the future for this technology remains secure.