4K TV Boom – Over 30M in 2014?

By David Hsieh

DisplaySearch

As shipments of LCD TVs passed the 200 million level and entered a more mature stage, panel makers and TV brands have been discussing how to grow the TV business to the next level. New features and smart TV are possible ways to drive growth. While consumers always rate “picture performance” as a top priority in our ongoing multi-country research, it is not easy for the supply chain to understand what features end users will pay for. 3D TV, driven by panel makers, TV brands, and other parts of the ecosystem, is not reaching as high a penetration rate as was expected, especially in an environment that consumers always care more about size and price. Panel makers are very aggressive in driving the 3D TV market but the results are not paying off. After 3D TV, everybody is asking what’s next.

As shipments of LCD TVs passed the 200 million level and entered a more mature stage, panel makers and TV brands have been discussing how to grow the TV business to the next level. New features and smart TV are possible ways to drive growth. While consumers always rate “picture performance” as a top priority in our ongoing multi-country research, it is not easy for the supply chain to understand what features end users will pay for. 3D TV, driven by panel makers, TV brands, and other parts of the ecosystem, is not reaching as high a penetration rate as was expected, especially in an environment that consumers always care more about size and price. Panel makers are very aggressive in driving the 3D TV market but the results are not paying off. After 3D TV, everybody is asking what’s next.

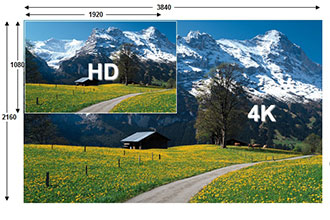

Now we have 4K TV.

High definition has proved to be an important trend in smart handheld devices, and as it provides an improvement to the viewing experience, 4K TV might be a feature end users are willing to pay a premium for. But the problem is that the supply chain is moving faster than the ecosystem and end-market.

4K, also called UHD (Ultra High Definition), is not just a flat panel TV specification but is becoming an indicator of differences among regional markets. We have pointed out how Chinese consumers are buying 4K TVs at relatively low prices, without content, broadcasting, or other elements of an ecosystem. We have been pointing out how low 4K TV prices are in China. In part, this is due to the fact that most 4K TVs in China run at 30Hz or 60Hz frame rates, or use FRC (frame rate conversion), which do not enable true 4K motion pictures.

However, outside of China, global TV brands position 4K TV as a premium product for consumers willing to pay a premium and who can acquire other parts of the 4K ecosystem. According to our high resolution report, 4K LCD panel shipments will be 2.7M in 2013, while 4K TV set shipments in 2013 might be about 1.5M, with one million in China alone.

China has become a booming market for 4K TV, as domestic TV brands heavily promote 4K as an advanced TV, while 4K TV prices are low enough to make it easy for consumers to adopt. Meanwhile, the promotions have led consumers in China to associate 4K with high resolution. The Chinese market opportunity has led many panel makers to adopt aggressive production plans for 4K panels in 2014. In our latest value chain survey indicates that panel makers, led by Innolux, are planning to ship over 30M 4K TV panels in 2014. If the panel makers achieve their targets, it would mean that 4K will quickly become the most adopted TV feature. The 4K market is supply driven, so cost and price will the key. Panel makers are putting great effort into reducing 4K panel costs, including:

- Lower driving frequency to reduce panel electronics cost

- Integration of 4K panel electronics, such as timing controller

- Revised backlight and LED structure to improve luminous efficiency

- Use of subpixel designs like RGBW with for higher brightness and yield rate

- Increased production scale to reduce depreciation cost and enhance yield rate

If 4K panel costs can be reduced, it can help TV brands reduce set prices, driving 4K adoption. The question is whether China alone can hold support such big growth or whether other regions develop like China to grow 4K TV, especially given the immature 4K TV ecosystem.

This column was reprinted with permission from Display Search and originally appeared here.