The Cost of Late Adoption

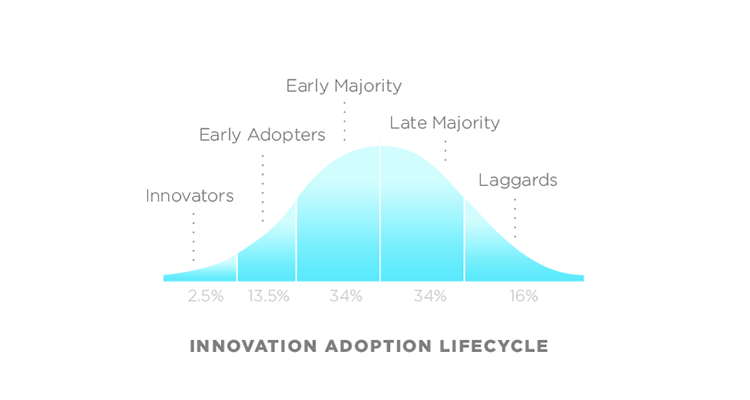

If you are a student of technology adoption, you’ve most likely seen this curve.

It’s the Technology Adoption curve and it reveals how people adopt technology over time. Looking at the curve as an integrator, you may use this curve to justify a delayed entry into a tech market. After all, around 70 percent of consumers don’t come into the market until the middle. If you take that viewpoint, you’re not alone. In fact, according to data I heard come out of the InfoComm standards plenary, integrators seem to adopt new technology into their businesses in almost exactly the same way consumers do, with the majority waiting for the swell in the middle. I think that this is a major mistake.

Before you start to disagree too much, let me lay out why I think there is a unique advantage for integration companies to be innovators and early adopters when it comes to offering new products and services in their businesses.

First off, it’s a marketing and sales advantage. 70 percent to 85 percent of the integration community is probably not telling this new technology story to their clients yet. That’s a great advantage when pitching a job, especially if the client is tech conscious or savvy themselves. However, I think there is a unique advantage in the actual numbers as well.

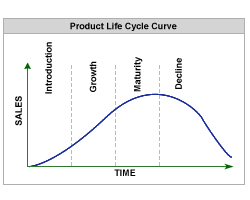

Let’s look at another common curve. The Product Life Cycle curve.

This curve, when over laid on the Technology Adoption curve above, shows that most integrators are waiting until growth has been demonstrated or sometimes even until the product has reached full maturity. This may not sound like a bad thing. In fact, the terms growth and maturity seem to denote stability.

But stability and profitability are two different things.

Now given all of the above let’s look at a couple curves I came up with in thinking through this adoption trend.

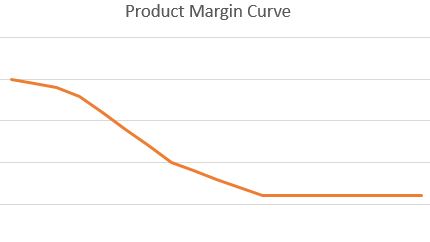

The first is the product margin curve.

When a product is first introduced and is novel or innovative, higher prices will be paid by consumers. Given this, typically products have higher margins as they are introduced and as the product reaches maturity and then market saturation, those margins fall and then level off at some small differential above the manufacturing costs.

But selling the product is only half of your integration business. Unless you are a box mover, you are selling installation, programming and support services with these products as well — so you also have a Labor Margin curve to factor in here as well.

Notice anything? It’s almost the opposite of the Product Margin curve. In the beginning, when a technology is new, your integration firm will inevitably spend more time training and installing the product, troubleshooting errors, etc. However, as the product reaches maturity, labor margins increase with the efficiency of the installations, programming and support of the product.

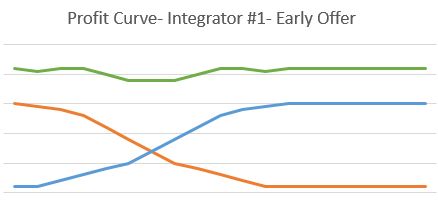

Given this, you really need to look at the sum of both graphs to get a good picture of the Profit curve of a integrating a new technology. If the product costs and integration costs are about equal, then you get something like this.

As you can see the green line is the sum of the two margin curves for Product (orange) and Labor (blue). Of course depending on the price of the product(s) in the system, these curves could move slightly. The point is however that in the example above, the integrator in question adopts the technology early. This means that the product margins offset additional labor expenditure during the learning phase, and then as product margins decrease, the integrators experience with the product provides advantages in actual integration costs to increase labor margins. Overall, the two competing curves can level each other out, creating a stable profit line over time for the technology itself.

But what happens to the integrator who waits?

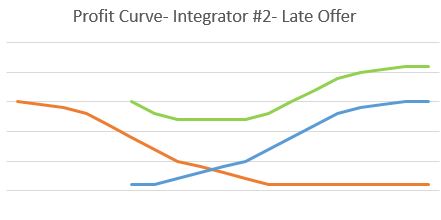

A delayed entry into the market in growth or maturity mode means that the integrator will not take advantage of early, higher product margins. However, the labor margin curve remains. As an integrator, it still takes your team some time to become familiar with the technology and gain those economies. The result is a product margin curve that remains the same and a labor margin curve that is delayed.

As you can see the delayed entry affects the stability of the green profit line. If you look at the curve profit curve above, you’ll notice that profit actually decreases initially, and that many times causes an integrator to rethink their entry into the new market and perhaps retreat, not knowing that the trend is a direct result of the late entry, and will at some point climb back up as efficiencies in installation and programming are realized.

If you want to compare the profit curves of integrator 1 and integrator 2, it looks something like this.

If you take a look at the two profit curves above, an early entry into the market not only allows Integrator 1 (dark green) the opportunity to turn profit for more time than Integrator 2 (light green), but also gives them an advantage in profit during a huge portion of the Technology Adoption cycle as a whole. They have earned higher profits that allow them to be more competitive in a bid situation as well as present a longer track record of success with the technology.

All in all, the early adopter from an integration perspective can benefit greatly from adopting technology early, capturing a large percentage of early adopters and also creating advantages downstream as the technology matures that allows the same firm to continue an advantage until the product fades toward decline.

From a product manufacturing perspective, many argue that being second may be better than being first in that the follower can learn from the leaders mistakes. That may also be true here with integration if the delay to market is relatively small. However, even in manufacturing, no one argues that there is an advantage to entering the market in the middle or at the end. It may be a good time to look at the way your integration firm is adopting new technology to see if you’re benefiting from an early mover advantage.

I’d love to hear your take here. Feel free to use the comments below to start the conversation.