Holdbacks

It’s not a particularly glamorous topic to write about, let alone read, but anyone whose work falls within the bounds of the construction industry needs to have a grasp of liens and holdbacks, since they affect all parties, including suppliers, subcontractors, general contractors and owners.

It’s not a particularly glamorous topic to write about, let alone read, but anyone whose work falls within the bounds of the construction industry needs to have a grasp of liens and holdbacks, since they affect all parties, including suppliers, subcontractors, general contractors and owners.

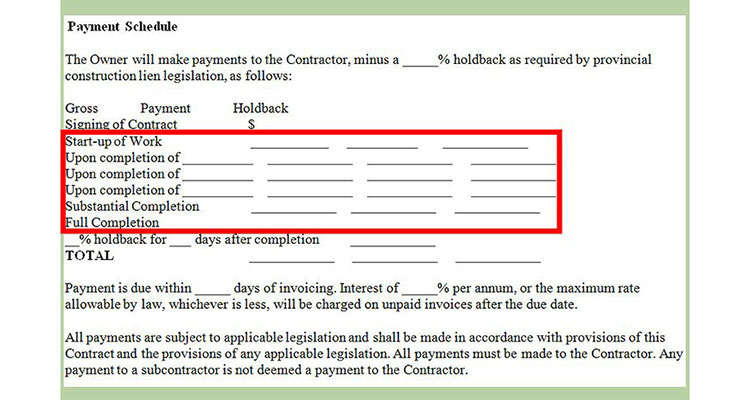

The definition of a holdback is related to its context, such as renovation or new construction, but broadly speaking a holdback is a percentage of the total cost of the contract that is kept unpaid until specified conditions are met, typically in regard to the client’s satisfaction that the project has been fully completed. There’s more to it than just that, which I will address shortly.

While the exact legal terms in the municipal or regional statutes that define holdbacks will vary from one place to another, they’re broadly similar. They specify a total amount (10 percent is common) that remains in escrow until after completion of the job.

And while it’s generally understood that the purpose of holdbacks is to ensure the client’s satisfaction, it’s primary purpose is to protect the client from liens against the property owner for unpaid bills by the primary contractor, sub-contractors or their suppliers.

To put it another way, the purpose of the holdback is to provide security for contractors and subcontractors who supply labor and materials to a project and to limit the liability of owners who have hired and paid a general contractor against liens filed by their subs. The holdback provision limits the liability of those who retain the holdback in the event that one of the subs files a lien.

Believe it or not, sometimes general contractors “forget” to pay their subs for the work they did on a project. If that happens, the only recourse the subs have is to place a lien on the property in an attempt to get paid. In most regions, the relevant contract law specifies a 45-day waiting period before the client pays the final hold back. At the same time, counterparties have that 45 days to file a lien, if they haven’t been paid.

The holdback is the client’s protection against that: Until the holdback has been released, the onus is on the primary contractor to ensure that all the subs and suppliers have been paid.

Bear in mind that a builders’ lien holdback is not intended to be used as a deficiency holdback or as compensation for delays or other claims relating to the work performed on the project. Those are another type of holdbacks or penalty, and need to be specifically written into the contract.

How completion holdbacks are typically structured in construction is that 10 percebt must be held back from every payment made on account for the contract. This either runs through the general contractor, or if the client is dealing directly with each trade, they’re expected to retain a holdback from each, separately.

In a situation where the general contractor doesn’t pay their trades and the tradespeople file liens against the property, the holdback funds are used to pay them, on a pro-rated basis, discharging the client’s obligation. Any remaining balance owing requires the trades to pursue the general contractor directly.

While it is most often the case that, as the AV company on the project, you’re dealing directly with the client, there are still many scenarios in which the AV is subordinate to the general contractor. The one that was most common in my personal experience was working with Multi-Dwelling Builders, doing the AV for condominiums.

Consequently, as a sub-contractor, the possibility of getting stiffed by the general contractor is very real. And even though you should seek legal advice when you find yourself in that situation, it’s also in your interest to learn the details of the specific legislation about liens and holdbacks in your area.

It’s one of those things that you don’t want to have to deal with, but it’s better to be prepared for it.